It’s inevitable there are times when you have to void a check. There are several reasons this can happen when a check is a duplicate, is lost and rewritten without being corrected properly. When bank reconciliations are done, it’s a great time to review outstanding checks for errors that need to be corrected.

When you need to void a check, there are several things to consider. Here a few tips to ensure it is done properly.

CHECK IN THE CURRENT PERIOD

If the check is in the current period, simply change the amount to zero. Leave everything else alone.

CHECK IN THE PRIOR YEAR

If the check is in a prior year, you have to be careful. It can create a mess with your balance sheet that could tie back to your tax return. We suggest making a deposit entry for the amount of the voided check. In the memo write Void Check #, who it was issued to, and original date.

CHOOSE THE RIGHT CATEGORY

In the account section, you can either use the original expense account as in prior period or write off. Consult with your CPA or tax preparer what account they prefer you use to clear our your old outstanding voided checks.

WHAT TO DO WITH A PAYROLL CHECK

If this check is a payroll check, and all payroll tax returns have been filed, voiding this check can have a huge effect on your books. The best way to handle this is to NOT void the check and to reprint it using a new check number. Ensure that the employee cashes the check. If the employee cannot be found, consult with your CPA or tax preparer how to proceed and if the above method would be appropriate to write it off.

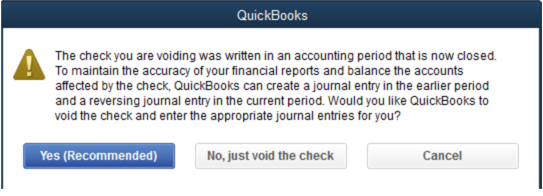

TOOLS IN QUICKBOOKS DESKTOP

Inside of QuickBooks Desktop when you use the Void feature by finding the check and clicking Edit, Void Check, it changes the amount to zero, this is fine if it’s in the current period. If try this in a closed period, you will get this pop-up message:

In this case, you can select the “Yes (Recommended). QuickBooks will void the check and enter the appropriate journal entries. If you want to control this step you can follow the steps above “Check in the prior year.”

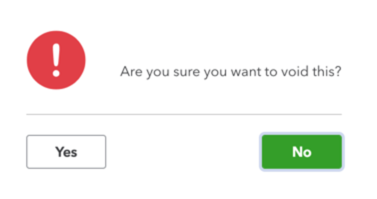

TOOLS IN QUICKBOOKS ONLINE

You always want to be careful to void in QBO because the data is coming from bank feeds and possibly tied to a bank reconciliation. When you open up a transaction and select MORE to choose void, you will get this pop-up message whether the check is has been reconciled or not.

If you answer yes, this will void by zeroing out the amount. If tied to a bank reconciliation, you will need to undo and redo bank reconciliations to make a full correction.

If you find that you need help cleaning up your checks and you aren’t comfortable doing it without assistance, click here to schedule a consultation with one of our team members.